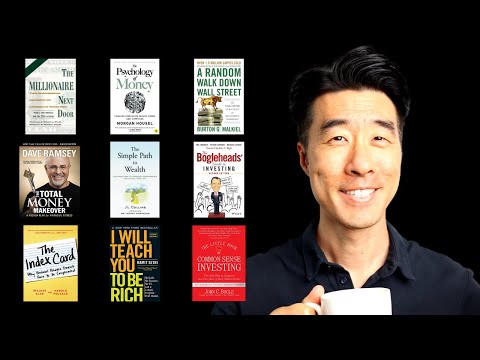

A Biased View of Best Investment Books

Wiki Article

Greatest Financial commitment Guides

You can find an assortment of financial investment publications, but some stick out. These titles have influenced and fashioned many of the greatest investors all through history and may be essential examining for anyone seeking to enhance their fiscal literacy or dollars management expertise.

Benjamin Graham's ebook on benefit investing, which entails purchasing shares for less than their intrinsic worthy of, is really an indispensable information. It teaches readers how to obtain actual returns with no taking pointless hazards on the market.

1. The Clever Trader by Benjamin Graham

What Does Best Investment Books Do?

In regards to investing, being clever with how you expend your hard earned money is paramount to both ensuring money security and furthering your profession aims. Revenue administration capabilities are priceless for legal professionals, Medical practitioners, expenditure bankers, electronic Entrepreneurs and digital marketers. It does not matter irrespective of whether you're just commencing or a highly trained Trader there is usually much more you are able to understand the industry and making sensible economic conclusions as a result of studying investing textbooks - regardless of your history.

In regards to investing, being clever with how you expend your hard earned money is paramount to both ensuring money security and furthering your profession aims. Revenue administration capabilities are priceless for legal professionals, Medical practitioners, expenditure bankers, electronic Entrepreneurs and digital marketers. It does not matter irrespective of whether you're just commencing or a highly trained Trader there is usually much more you are able to understand the industry and making sensible economic conclusions as a result of studying investing textbooks - regardless of your history.Benjamin Graham, the pioneer of benefit investing, wrote The Clever Trader in 1949 as a basic that needs to be on each individual investor's shelf. It facts the importance of lengthy-time period investing and how to stay away from overpaying for stocks; its concepts referring to speculation vs audio investments continue being suitable today which e-book must be go through by new and veteran buyers alike.

Benjamin Graham and David Dodd's Protection Evaluation is another essential addition to every Trader's library, giving an available introduction to value investing principles and apply. An excellent read for newbies or everyone wanting to delve further into its ideas - its central plan being: only buy cheap stocks instead of only on price tag alone!

This e book not just introduces the fundamentals of investing, but In addition, it addresses debt administration and property investments. Students as well as every day buyers alike have praised its clarity and wisdom - it is crucial reading through for virtually any aspiring or active Trader.

On the list of most important worries connected with beginning to invest is realizing how to safeguard your belongings towards market place fluctuations and Restrict possibility. This e-book can help new buyers stand up and functioning by giving straightforward tips for shielding assets and mitigating hazard - it even covers how very best to make the most of retirement funds like 401(k), IRA and Roth IRA accounts.

two. The Little Guide of Widespread Feeling Investing by Robert Kiyosaki

Among the major beginner expenditure textbooks, this guide provides visitors with every one of the instruments necessary to assemble their very own portfolios. Rather than utilizing complicated economic jargon, this tutorial takes advantage of simple language to elucidate principles in uncomplicated steps - such as choosing an asset allocation and deciding on funds; and also Positive aspects linked to passive investing.

This ebook emphasizes the significance of solid Trader self-discipline for success. Also, diversification and compound fascination are pressured. Particular anecdotes with the writer assistance bring these principles alive and exhibit why they make a difference a lot of.

This 1949 vintage remains important reading for anybody hoping to take advantage of purchasing stocks. It offers Guidelines on recognizing and examining firms and also techniques for investing. Moreover, this book teaches about getting discounted shares though avoiding prevalent pitfalls like turning into seduced by tendencies and subsequent fads.

Best Investment Books - Questions

The author employs the grocery store as an illustration to demonstrate how traders can attain a considerable edge by only purchasing underpriced items. Such a investing, often known as price investing, aims to search out organizations with sustainable aggressive strengths whose share value mirror this aggressive edge. While value investing may well seem appealing at first, recall it demands persistence and commitment.

The author employs the grocery store as an illustration to demonstrate how traders can attain a considerable edge by only purchasing underpriced items. Such a investing, often known as price investing, aims to search out organizations with sustainable aggressive strengths whose share value mirror this aggressive edge. While value investing may well seem appealing at first, recall it demands persistence and commitment.This book, the youngest on this listing, needs to be browse by any one attempting to enter the stock current market. It outlines Peter Lynch's techniques for beating the market - earning him among background's good buyers. It teaches common traders can leverage certain pros over huge dollars administrators like tax breaks and knowing a corporation's economic moat; also emphasizing acquiring shares of substantial-high-quality organizations and getting a disciplined tactic when shopping for stocks; it emphasizes comprehending that markets could be volatile; strategy appropriately!

three. The Buffett Rule by Warren Buffet

The very best investing books will teach you the way for making audio financial conclusions and develop your capital proficiently. Studying these kinds of publications might make even non-economical specialists into thriving investors; like an entrepreneur, lawyer, health care provider or digital marketer it might show particularly useful in giving important information to shoppers or superiors at do the job.

Warren Buffett is considered check here amongst the best traders ever, and this reserve gives insights into his thriving investing procedures. It clarifies why it is best to speculate in excellent businesses investing at fair valuations; how in order to avoid creating emotional choices; the many benefits of diversification; and why persistence should always be exercised when investing.

This e book is often thought of the "bible" of stock market investing. It addresses fundamentals including worth investing - an approach advocated by Warren Buffett and other profitable traders - and also knowing company metrics and examining a balance sheet. This textual content is good for novices in search of their get started in investing.

Burton Malkiel was an authority at distilling intricate Tips into obtainable books that everyone could study very easily, along with a Random Stroll Down Wall Avenue by Malkiel needs to be expected studying for anybody wishing to obtain the basic principles of investing. Malkiel's guide offers classes in diversification of portfolios and why index cash are exceptional inventory buying strategies - this perform of literature was even suggested by quite a few successful hedge fund managers them selves!

The 7-Minute Rule for Best Investment Books

Peter Lynch was certainly one of the best fund professionals ever, earning a mean annual return of 29% at Magellan Fund in the course of his time there. Significantly of his success is often credited to classes taught Within this ebook which explores how specific buyers can gain positive aspects more than significant income administrators by using their understanding of businesses' industries to their own profit. It is highly advised by Bruce Berkowitz, John Griffin and Dan Loeb for all traders alike.

Peter Lynch was certainly one of the best fund professionals ever, earning a mean annual return of 29% at Magellan Fund in the course of his time there. Significantly of his success is often credited to classes taught Within this ebook which explores how specific buyers can gain positive aspects more than significant income administrators by using their understanding of businesses' industries to their own profit. It is highly advised by Bruce Berkowitz, John Griffin and Dan Loeb for all traders alike.4. The Small Reserve of Common Sense Trading by Mathew R. Kratter

Being an investing novice, starting out can be intimidating. From wanting to place that unused cost savings account dollars to work to brushing up on investing capabilities - these textbooks gives you every little thing you have to know on investing sensibly although safeguarding from current market fluctuations.

This e book uses parables established in historical Babylon to teach standard ideas for saving and investing funds. It really is an uncomplicated study with more than eighty,000 5-star opinions on Goodreads; its messages train audience to put aside 10% of their earnings for investment with guidance prior to making choices with regards to the place it ought to go; Moreover you are going to study preventing undesirable investments and also what actions ought to be taken if problems have by now been manufactured.

Created by a behavioral finance pro, this e book is for anyone searching to further improve their investing general performance. It demonstrates how Trader actions best investment books and thoughts affect decisions designed, ahead of detailing ways in which these might be altered for better investing general performance. That includes an obtainable conversational type producing format which makes the guide very easy to study.

Benjamin Graham's typical reserve, The Smart Trader, must be on each investor's reading list. Below he lays out his benefit investing philosophy whilst instructing visitors to invest in high-quality firms when they're undervalued though keeping away from dangerous speculation investments. It proceeds to encourage today's investors as its message continues to be timeless.

John Bogle's Security Analysis must also be on any investor's looking at record, due to source the fact he Started Vanguard and launched index mutual cash. This reserve encourages its reader to undertake a long-expression viewpoint and lower fees just as much as you possibly can though dollar Value averaging is usually released to be a proven strategy for steady investing.